Laboratory for Manufacturing Systems & Automation, University of Patras

The Laboratory for Manufacturing Systems & Automation (LMS) is oriented on research and development in cutting edge scientific and technological fields. LMS is involved in a number of research projects funded by the CEU and European industrial partners. Particular emphasis is given to the co-operation with the European industry as well as with a number of "hi-tech" firms. LMS is under the direction and technical coordination of Professor George Chryssolouris. It is organized in three different groups:

- Manufacturing Processes Modelling and Energy Efficiency

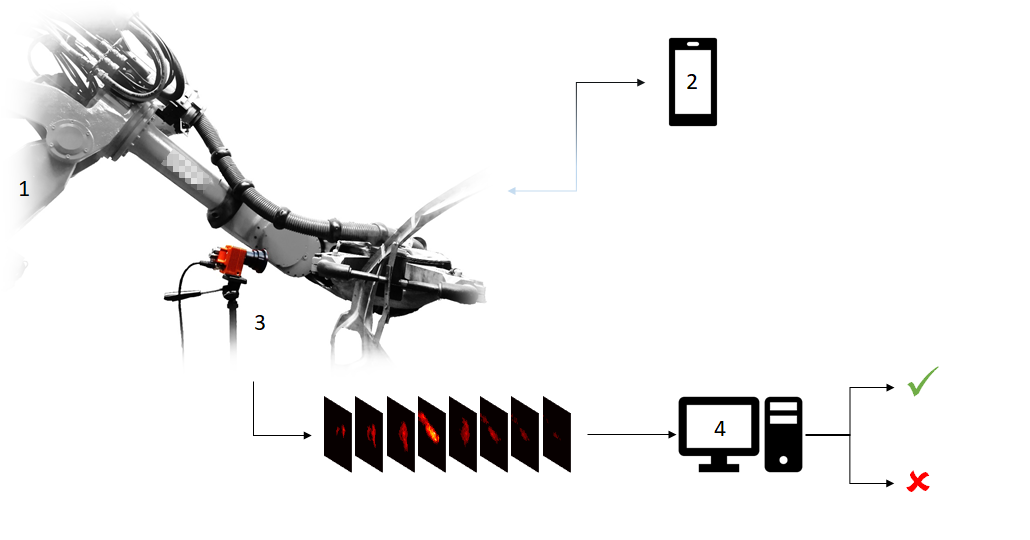

- Robots, Automation and Virtual Reality in Manufacturing

- Manufacturing Systems